Where to start

Starting a business involves quite a few things but first, you want to choose the right business structure to avoid paying a lot in tax later on. You should choose a business structure that gives you the right balance of benefits and legal protection of your assets.

Minimize your taxes early on

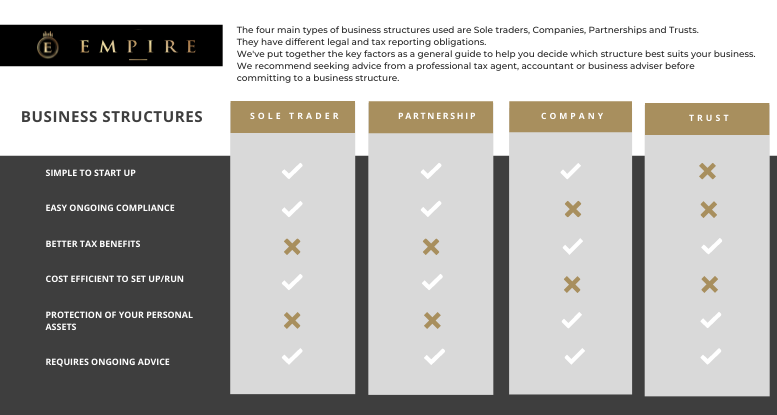

If you are a sole trader, your tax rate may be higher as your income increases. It can reach up to 48%. A company with the same income might only pay 28.8% in tax. To help you choose the right structure for your circumstance, we recommend consulting a business advisor or accountant. By doing so, you won’t miss anything important, and you’ll feel less stressed. You will think about your finances every single day, so you need to get them right.

Step by step - Easy exercise

We believe that if you write something down, you have a greater chance of achieving it — and if you see it, that chance doubles — so here is a quick exercise to get you started.

- Identify your priorities as an entrepreneur.

What are my non-negotiables?

What is my goal that can not be downgraded?

What is the one thing I do every day to help me achieve my goal?

- Professional Advice.

What is the name of the professional I consult with?

- Decide which structure is best suited for your business.

(Sole trader, Company, Partnership, Trust etc).

- Check the availability of your business name (website/domain too)

What is the name of the business?

How well does it reflect your brand?

Is the name already taken?

Which domain name do you have?

What is the URL of the website?

What is your social media name?

- Your business name needs to be registered.

For easy self-registration go to https://register.business.gov.au/registration/type or click on the link below.

- You should register for GST

Taxis, limousines, and Uber drivers must register regardless of their income because it isn’t taken into account.

GST registration is required for fuel tax credits.

- Register for PAYG

If you plan to hire employees.

STP (Single Touch Payroll) You need to notify the ATO of a payroll event on or before the pay date.

- Set up a bank account.

Everyday Business Account – money goes in, weekly supplies costs come out.

GST Account – put aside for GST and ATO obligations.

War Chest – Build your savings for opportunity or a rainy day.

- Write your business plan.

Your priorities will become clearer and you’ll have more direction.

Helps you get finance – you’ll need to show banks and investors why they should invest in your business.

When to consult an accountant

Early advice can save you money at tax time. Choosing the right business structure involves so many elements, and it is the accountant’s job to look at your business and assets to identify the best structure for you and your business. You might learn something about taxes that you didn’t know before. It is a great idea to have an accountant estimate how much tax your business will owe – so you know what to expect at tax time.

Last but not least, if you need to change your business structure in the future, you can.

We have created a comparison chart for Different Business Structures to assist you in getting started. You can instantly see the features of each business structure and how they differ.